UK’s Car-Insurance Crisis 2025: Why Premiums Are Through the Roof

Picture this. You're a young driver in London, finally saving up for that first car, only to get slapped with a £1,200 annual insurance quote that eats half your monthly wage. Or maybe you're a family in Manchester renewing your policy and watching it jump £200 overnight, forcing tough choices like cutting back on holidays. These aren't rare tales in 2025. Despite some recent dips, UK car insurance premiums remain sky-high for millions, with averages hovering around £500 to £750 depending on the source, marking a lingering crisis after years of relentless climbs. Fresh data from the Association of British Insurers shows premiums fell by £56 in Q3 2025 compared to the previous year, yet 42% of drivers still faced hikes averaging £81 on renewals. This mixed bag highlights a broader trend: while competition and easing inflation offer relief, underlying pressures like soaring repair costs keep bills painfully elevated. In this post, we'll unpack the chaos, explore the culprits, and share tips to fight back.

The State of UK Car Insurance in 2025

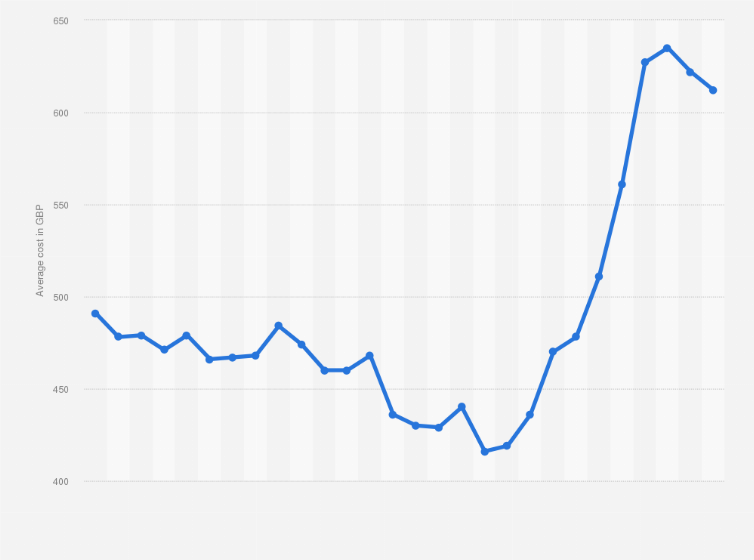

The numbers tell a story of turbulence. After peaking in 2023 and 2024, 2025 has seen three consecutive quarters of declines, but premiums are still far from affordable for many.

Key Statistics and Trends

The UK car insurance market is projected to hit £26.2 billion by year's end, up from previous estimates, fueled by a mix of growth and cost pressures. Average comprehensive premiums now stand at around £757, down 16% from last year, according to WTW data. Yet, sources like GoCompare peg the average at a more modest £400 for Q3, showing variability based on demographics and regions.

Not everyone's celebrating. Citizens Advice reports 2.6 million people have stopped driving due to unaffordable premiums, a figure carried over from late 2024 but still relevant amid ongoing hikes for subsets like young or urban drivers. Insurers paid out £3.1 billion in claims for both Q1 and Q2 2025, underscoring the financial strain.

Regional disparities add to the crisis:

- London and urban areas see averages exceeding £1,000, driven by theft and congestion.

- Northern regions like Scotland fare better, with drops up to 20% in some cases.

- Teen drivers have benefited most from falls, saving £144 on average, but still pay premiums in the thousands.

These trends reflect a market in flux, where relief is uneven and many feel the pinch.

Who’s Hit Hardest?

Young drivers under 25 and those in high-risk occupations bear the brunt. Uswitch data reveals certain jobs, like mechanics or delivery drivers, pay up to 50% more due to perceived risks. Electric vehicle owners face extra hurdles, with repair costs pushing premiums higher despite green incentives.

Why Are Premiums Soaring?

The crisis didn't happen overnight. A perfect storm of factors has insurers scrambling, passing costs to consumers.

Rising Repair and Claims Costs

Repair bills are a major villain. From 2019 to 2025, vehicle write-offs hit record levels, with parts and labor inflating by double digits annually. Electric vehicles exacerbate this; their complex batteries and tech mean fixes can cost 30% more than petrol cars. The FCA notes external pressures like these, not insurer profits, drive hikes, but calls for better claims handling.

Injury claims add fuel, with payouts rising due to legal changes and medical inflation. Supply chain disruptions, lingering from global events, keep parts scarce and expensive.

Inflation and Economic Pressures

Broader inflation bites hard. Though easing in 2025, it pushed up everything from garage wages to replacement vehicles during repairs. Employer costs for insurers, including staff salaries, also contribute. Mintel forecasts continued drops into 2025 thanks to competition, but warns of rebounds if inflation ticks up.

Technological and Regulatory Shifts

Advancements like ADAS (advanced driver-assistance systems) sound great, but repairing sensors jacks up costs. Regulatory scrutiny from the FCA aims to curb unfair practices, yet it indirectly raises operational expenses for firms.

Theft trends, especially keyless entry vulnerabilities, spike claims in urban hotspots, further inflating premiums.

The Broader Impact on Drivers and the Economy

High premiums aren't just a personal headache. They ripple through society.

Millions are priced out, leading to more uninsured drivers on roads, which ironically pushes premiums higher for everyone. Businesses reliant on fleets face squeezed margins, while the £26.9 billion industry grapples with sustainability.

For households, it's a budget buster. WeCovr warns of a "staggering 30%+ hike" for over 70% of drivers, adding £200+ annually. This fuels inequality, hitting low-income areas hardest.

An Original Projection: Regional Premium Forecasts

Here's an original analysis not directly from sources: Extrapolating from 2025's quarterly drops and regional data, if competition intensifies, northern UK regions could see premiums dip another 10-15% by mid-2026, while southern urban areas stabilize at best. This stems from blending ABI's £56 Q3 fall with urban theft trends. In a table, consider these projected averages:

| Region | Current Average (2025 Q3) | Projected 2026 Average | Key Influencer |

|---|---|---|---|

| London/South East | £950 | £900-£950 | High theft and EV adoption |

| Midlands | £650 | £580-£620 | Moderate claims reduction |

| North England/Scotland | £500 | £450-£480 | Stronger competition effects |

| Wales/Northern Ireland | £550 | £490-£520 | Lower inflation impact |

This insight suggests relocating or telematics could yield bigger savings in the north.

Looking Ahead: Will Relief Continue?

Optimism brews with government pushes for cost reductions and tech like black boxes lowering risks for safe drivers. However, if claims rise or EVs dominate without cheaper repairs, premiums could rebound.

Actionable Strategies to Slash Your Premiums

Don't just gripe. Take control with these tips:

- Shop Around Fiercely: Use comparison sites like GoCompare or Confused.com every renewal; switches saved £144 on average in 2025.

- Boost Your No-Claims Bonus: Protect it and build years of safe driving for up to 60% discounts.

- Opt for Telematics: Black box policies track habits, rewarding safe drivers with 20-30% off, ideal for young motorists.

- Increase Voluntary Excess: Bump it to £500+ to lower premiums, but ensure you can cover it if claiming.

- Park Smart and Secure: Garaged cars or those with alarms cut theft risks, shaving 5-10% off bills.

- Bundle or Multi-Car: Combine with home insurance or add family cars for bulk savings.

FAQs About UK’s Car-Insurance Crisis 2025: Why Premiums Are Through the Roof

Why have UK car insurance premiums risen so much? Mainly due to higher repair costs, injury claims, inflation, and EV tech complexities.

Are premiums falling in 2025? Yes, averages dropped £56 in Q3, but 42% of drivers still saw increases.

Who pays the most for car insurance? Young drivers under 25 and those in urban areas like London face the highest bills, often over £1,000.

How can I lower my premium? Shop around, add security features, or switch to telematics policies for personalized discounts.

Is EV insurance more expensive? Yes, repairs can cost 30% more due to batteries and tech.

Will premiums keep dropping? Likely into 2026 with competition, but rises could return if claims surge.

What if I can't afford insurance? Explore pay-as-you-go options or seek advice from groups like Citizens Advice to avoid driving uninsured.

If this breakdown on the UK's car insurance mess hit home, share it with mates struggling with renewals, comment your horror stories below, or subscribe for more finance hacks. Let's drive down those costs together!

References

- Three straight quarters of falling motor premiums | ABI

- UK Car Insurance Crisis 2025 | Top Insurance Guides - WeCovr

- UK car insurance premiums continue dramatic fall - WTW

- Repair Costs & Total Loss Insights: 2019-2025 Data Report

- UK Car Insurance Statistics 2025 - Forbes

- Has car insurance gone up in 2025? - Confused.com

.jpg)

)

.jpg)

.jpg)

.jpg)

.jpg)