Your Credit Score Is Quietly Taxing You: How Insurers Hike Your Rates

Ever feel like your wallet's getting squeezed from every angle? Between skyrocketing grocery bills and that unexpected car repair, the last thing you need is another hidden fee. But here's a sneaky one you might not see coming: your credit score could be jacking up your insurance premiums without you even realizing it. In today's economy, where inflation's still biting and folks are stretching their budgets thinner than ever, insurers are leaning hard on credit checks to decide your rates. Think about it, you pay your auto or home insurance on time every month, but if your score dips from a medical bill or job loss, bam, higher costs. It's like a silent tax, and it's hitting millions of Americans right now. Let's unpack how this works, why it's happening, and what you can do to fight back.

What Is a Credit-Based Insurance Score Anyway?

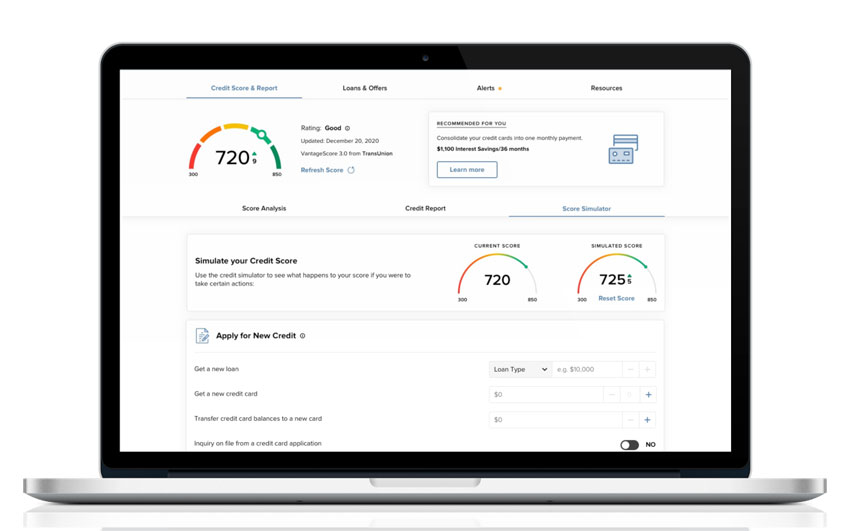

You know your FICO or VantageScore for loans and credit cards, but insurers have their own twist: the credit-based insurance score. It's not exactly the same as your regular credit score, but it's derived from your credit report. Companies pull data on your payment history, debt levels, credit length, new accounts, and types of credit used. They crunch these into a score that predicts how likely you are to file a claim.

Why do they do this? Studies backed by the industry show a link between poor credit and higher claim risks. Insurers argue it helps them price policies more accurately, keeping rates lower for responsible folks. But critics say it's unfair, punishing people for financial hardships beyond their control, like job loss or illness. In most states, this practice is legal and widespread, affecting auto, home, renters, and even some life insurance policies.

The Science Behind the Score

Insurers don't just eyeball your credit; they use sophisticated models. For example:

- Payment history (35% of FICO) weighs heavy, as late payments signal unreliability.

- Outstanding debt: High balances relative to limits can ding your score.

- Credit history length: Longer is better, showing stability.

- New credit: Too many inquiries? It looks risky.

- Mix of credit: A blend of cards, loans, and mortgages can help if managed well.

This score isn't shared with you upfront, but you can request it from your insurer or check your credit reports for clues.

How Your Credit Score Impacts Auto Insurance Rates

Picture this: You're shopping for car insurance, and two drivers with identical records one with stellar credit, one with a bumpy score get wildly different quotes. On average, drivers with poor credit pay 76% more for full coverage than those with good credit. That's not pocket change; it could mean hundreds extra per year.

Take a real-world example. In a study, dropping from excellent to poor credit hiked rates by over 115% in some cases, adding $542 annually for the same coverage. Why the big jump? Insurers claim folks with lower scores file more claims, though the correlation isn't perfect. If you're in a state like Texas or Florida, where rates are already high due to weather risks, a low score compounds the pain.

Real Numbers on Rate Hikes

Here's a quick breakdown from recent data:

- Excellent credit (800+): Baseline rates, say $1,500/year for full coverage.

- Good credit (670-739): Maybe 10-20% higher.

- Fair credit (580-669): Up 50% or more.

- Poor credit (below 580): Often 76% to 115% increase, pushing costs to $2,500+.

Even a single tier drop can add 17% or $355 yearly. And if your score tanks by 80-100 points? Expect a renewal surprise.

If you like reading this blog then you'll like reading this information here: Liability or Full Coverage? The Insurance Choice That Actually Matters

The Effect on Homeowners Insurance Premiums

It's not just your wheels; your roof feels the pinch too. Poor credit can nearly double homeowners rates in many states, with averages jumping 71% from $2,100 to $3,620 yearly. That's over $1,500 extra just because your score slipped.

Home insurers use similar logic: Credit as a proxy for responsibility. If you're rebuilding after a storm or filing for theft, they bet on your financial habits. In high-risk areas like California (ironically, where credit use is banned for auto), this can make affording coverage tough. Renters aren't immune either; policies often factor in credit, adding to monthly burdens.

Broader Home Insurance Trends

With home values up and disasters on the rise, premiums are climbing nationwide. Add a low credit score, and you're looking at:

- 35% hike for scores below 580 vs. 740+.

- Potential denial of coverage in extreme cases.

- Higher deductibles forced on you.

It's a vicious cycle: High rates strain finances, potentially worsening credit.

States Fighting Back Against Credit-Based Pricing

Not everywhere lets insurers play this game. A handful of states have said "enough" and banned or severely limited credit use in insurance rating. If you live in one, breathe easy your score won't directly hit your wallet here.

The key states include:

- California: Bans for auto and home.

- Hawaii: Prohibits for auto.

- Maryland: Limits use, requires justification.

- Massachusetts: Full ban on credit for auto.

- Michigan: Restricts heavily.

- Oregon and Utah: Strict rules on how credit factors in.

These protections stem from fairness concerns, especially for low-income or minority communities disproportionately affected. More states are eyeing reforms, with bills in places like New York and Washington pushing for change. If you're in a ban state, focus on driving record and home maintenance instead.

Practical Tips to Boost Your Credit and Lower Rates

The good news? You can take control. Improving your credit isn't overnight magic, but consistent steps pay off in lower insurance costs. Start by pulling your free annual credit reports from AnnualCreditReport.com to spot errors.

Here are actionable tips:

- Pay bills on time: Set autopay to avoid late hits, which crush 35% of your score.

- Reduce debt: Aim to keep credit utilization under 30%; pay down cards strategically.

- Avoid new credit: Limit applications to prevent hard inquiries.

- Build history: If new to credit, get a secured card and use it responsibly.

- Dispute errors: Challenge inaccuracies; they affect up to 1 in 5 reports.

- Catch up on payments: If behind, negotiate plans to get current.

- Monitor regularly: Use free tools from Credit Karma or your bank.

Give it 3-6 months, and you could see score jumps leading to rate drops at renewal. Shop around too; some insurers weigh credit less heavily.

When to Seek Help

If overwhelmed, talk to a credit counselor through nonprofits like the NFCC. They can guide debt management without hurting your score further.

FAQs About Your Credit Score Is Quietly Taxing You: How Insurers Hike Your Rates

- Does every insurer check credit? Most do in allowed states, but some like Root or CURE focus less on it.

- How much can poor credit raise my auto rates? On average, 76% more, or $1,000+ yearly for full coverage.

- Is credit used for all insurance types? Mainly auto, home, and renters; life insurance sometimes factors it in.

- Can I get insurance with bad credit? Yes, but expect higher rates or limited options; shop multiple quotes.

- How long does a credit dip affect rates? Until your score rebounds, typically 3-6 months with improvements.

- What if my low score is from hardship? Some states let you request exceptions for events like illness or divorce.

- Do bans on credit use save money? In ban states, rates are based more on driving/home factors, potentially fairer.

Take Charge of Your Finances Today

Don't let a number on a report quietly drain your bank account. Understanding how your credit score taxes you through insurance hikes is the first step to savings. Check your score, implement those tips, and shop for better rates you could slash hundreds annually. Ready to get started? Head to AnnualCreditReport.com for your free report, or contact a counselor for personalized advice. Share your story in the comments: Has credit ever bumped your premiums? Let's turn the tide together!

References

- Which States Prohibit or Restrict the Use of Credit-Based Insurance Scores? - Experian

- Does Your Credit Score Affect Home Insurance Rates? - NerdWallet

- Drivers With Poor Credit Pay 76% More for Insurance - Bankrate

- Credit-Based Insurance Scores - NAIC

- Drivers With Poor Credit Pay Twice as Much for Car Insurance - The Zebra

- How Your Credit Score Affects Car Insurance Rates (& How to Fix It) - Ocho

.jpg)